Why should buyers & sellers choose to settle electronically?

The answer is best served by asking another question – “What is wrong with the old fashioned, paper based system that the electronic system replaces?”

We recently helped clients purchase their first home. It was due to settle in paper on a Friday afternoon & clients were planning to move in over the weekend. Unfortunately settlement was cancelled as the paper Certificate of Title & Discharge documents did not arrive at the seller’s bank in time for settlement. The buyers were obviously extremely disappointed and asked “Why can’t this be done over the internet?” Well now it can!

So what else can go wrong in paper?

In paper, each of the four participants in a property settlement (seller’s/buyer’s settlement agent/bank) enters information into their own workspace to create the documents/cheques required for settlement. This has the inherent risk of “fat finger” errors. If one party makes a mistake there is a good chance that settlement will be delayed.

Conversely, in PEXA (currently the only platform available for electronic settlements) all participants share the same workspace. This database uses Title information imported directly from Landgate. Any additional information entered by participants is cross-referenced to ensure correctness/consistency thereby avoiding the most common errors we see in paper settlements:

- Lost/delayed documents

- Errors, omissions & inconsistencies in Discharge, Transfer & Mortgage documents

- Errors in bank cheques

- Failure of all four participants to attend the right place at the right time

Additional benefits of electronic settlement:

- Certainty of settlement – no need to cancel the removalist

- For the buyer – faster registration of ownership on Title.

- No bank cheque fees (average cost to buyer in paper approx. $45)

- For the seller -get your money faster – no need to wait for cheques to clear

This is an example of the paper trail in a traditional settlement. All four parties enter information into their own database to create the necessary documents/cheques required at settlement. These documents/cheques are not checked for consistency until all parties attend at the agreed date, time & location of settlement. Each arrow line is therefore an opportunity to errors to occur that may delay settlement.

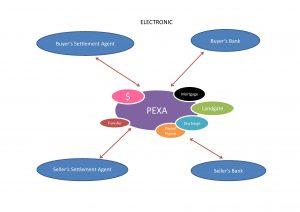

This is the workflow of an electronic settlement.

All parties use the same database that is populated by Title information supplied by the Land Registry. Each arrow represents a means of cross-referencing and checking data before settlement.

Whilst some conveyancers, settlement agents & solicitors are unable or unwilling to offer this revolutionary service to clients, Personalised Settlements is pleased to be at the forefront of this exciting development in the future of electronic conveyancing.

UPDATE: The Registrar of Titles will introduce new Registrar’s Requirements under Section 182A of the Transfer of Land Act 1893 requiring all eligible land registry documents to be lodged electronically through an electronic lodgement network such as the one operated by Property Exchange Australia (PEXA) in a phased implementation commencing 1 August 2017.